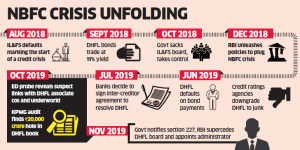

The collapse of IL&FS froze the credit markets and the contagion spread.

Financial institutions’ meltdown could be quicker than wax. Often, it’s chaotic. When JPMorgan’s head of investment banking Douglas Braunstein sat to negotiate a Federal Reserve backed rescue of Bear Stearns in 2008, all that he offered was $1. Overnight the storied financial institution lost 90 per cent value. More than a decade later when Infrastructure Leasing & Financial Services’ fortunes began to slide, its venerable shareholders orphaned it.

The collapse of IL&FS froze the credit markets and the contagion spread. Non-banking finance companies were shut out of the market throwing investors into a tizzy and speculation over which would be the next domino to fall. It fell. Dewan Housing Finance Co, a mortgage lender, began defaulting and it was a scramble among lenders to grab their share of what was left. There was no law to deal with these failures.

Last week, the government stepped in to prevent both — a sudden erosion in value of a financial services company, and for an orderly wind-up or resolution of a failed institution. It empowered the regulator to direct bankruptcy proceedings of a financial institution, which was lacking though a bankruptcy law became operational in 2016.

Unlike manufacturing companies, which affect only a small set of suppliers and customers, troubles in a financial institution could lead to risk aversion and their interconnectedness could lead to even sound companies finding it difficult to access credit and meet their obligations.

“There is no other way. If the NBFC is in trouble, how else will you resolve the issue in a timebound manner and put a stop on the misdoings of the NBFC,” says Ravi Subramanian, CEO, Shriram Housing Finance. “Till now NBFCs have got away with murder because no one wanted to dip their fingers into it. Now, if resolutions are monitored and driven by the regulator, it will keep in mind the interests of both lenders and the public depositors.”

Since IL&FS collapsed in September last year, without announcing any bailout or liquidity window for the struggling non-bank lenders, the government and the Reserve Bank of India announced several measures to arrest the collapse of the non-bank lending space that contributes over 20 per cent of the total credit.

The regulator announced measures to increase liquidity in the system aiding banks to lend to NBFCs, and relaxed securitisation and priority sector norms. The government, on its part, announced a partial credit guarantee scheme, which remains a non-starter till date. But these moves did not bring relief across the board, but selectively.

Regulator-led resolution

Empowered with the new law, the Reserve Bank of India moved quickly to sack the board of DHFL and appoint an administrator that provides hope for public deposits worth Rs 6,000 crore and lenders who are owed nearly Rs 1 lakh crore.

“Under the amended law, the resolution process can only be initiated by the regulator, the Reserve Bank of India,” says Alka Anbarasu of Moody’s Investor Services. “RBI’s close involvement in the process indicates the NBFI sector’s importance to overall financial stability, including the direct effect of any systemically important NBFI’s failure on banks and other credit providers.”

Getting the regulator at the centre of the resolution of financial services companies gives comfort in the background of lenders have been found to be far too slow in taking decisions when it came to either sending companies to NCLT or deciding upon the resolution of stressed assets.

“History has shown that without the regulator’s involvement, things are not moving at all, so the idea is a regulatory push is required to resolve this mess,” says Kuntal Sur, partner – financial services, PwC. “In India, unlike in many other evolved markets, self-regulation does not work and, hence, the regulator will have to forcefully do things.”

While the engagement of the regulator may provide comfort to many market players, the involvement of the central bank in the resolution process raises questions on the role of the lenders. It could also get the regulator entangled in a web of cases where it may not have the bandwidth to deal with.

“Making the regulator do this and it is accepting this duty, is questionable in my mind because then what are banks doing, a regulator cannot become party to such commercial decisions,” says Ashvin Parekh, managing partner, Ashvin Parekh Advisory Services, a financial advisory firm. “Even its independence is impaired, how much the regulator may succumb to political patronage will also become a play not only for this government but for the government’s thereafter.”

Bankruptcy: Another test by fire

The Indian bankruptcy code was designed to deal with the collapse of corporate debtors, and since financial institutions are different, a separate law was sought to deal with the bankrupt financial firms. Almost two years ago, the Financial Resolution and Deposit Insurance bill was shelved due to public outcry over the depositor bail-in clause. But, is IBC the best way to treat bankrupt financial institutions It may not be.

“Financial companies require special treatment with experts on board. The financial industry is very different from other sectors where assets like land and machinery are quantifiable. Here all assets sit on the book,” says Rajesh Narain Gupta, MD, SNG Partners, a law firm. “The minute you take an NBFC to NCLT, customers who have to pay-back may run away, this will lead to a faster death.”

For an institution with lakhs of customers – be the depositors or borrowers – the appearance of stability is more important as customer behaviour could change quickly. That would throw fresh challenges to the regulator, who would be seen as an owner running an enterprise through an administrator.

So any delay in the judicial process could cause more harm than good. Even the NCLTs have become notorious for delays in approving resolution packages, or admitting, or hearing of cases. Many frivolous cases are being filed which clog the system.

“The law by itself is a good piece of legislation to deal with defaults,” says Sridhar Ramachandran, chief investment officer at IndiaNivesh Renaissance Fund that buys distressed assets. “But the challenge is how quickly the NCLT process gets completed.”

But this can well be a signal for errant management to behave.

“This is a warning to either shape-up or ship-out, but we also need to think the way financial sector works,” says PwC’s Sur. “It’s a sector where tangible assets are less unlike the manufacturing sector. This is a highly leveraged sector, plus if it is going to IBC it means that the underlying loans are not performing well.”

With DHFL ordered to bankruptcy, deposit holders with overall exposure of Rs 6,000 crore are at risk of losing their savings. Public deposits contribute 7 percent of the overall borrowing mix of Rs 83,900 crore. Debenture holders have 37% exposure followed by 31 per cent bank term. But, the IBC recognises the primacy of secured lenders, it is to be seen how the resolution of a nonbank entity is undertaken under the IBC with large number of fixed deposit holders.

“Almost all of them have 20 percent of their liquidity as deposits. The moment a few cases of such nature are referred, I am hoping that there will be changes made that would keep depositors at par with lenders when it comes to bankruptcy of financial institutions. We cannot do justice with this process if individual depositors are kept at a much lower level,” says Subramanian.

The bankruptcy has seen many tweaks and changes since it was introduced in 2016. There have been challenges to its provisions, including whether it was constitutionally valid and the grading of creditors. But the Supreme Court has upheld many provisions of the law that would give comfort to lenders and investors.

But what about extending it to financial companies?

“Whether this experiment will be successful The first case will be the test of that,” says PwC’s Sur